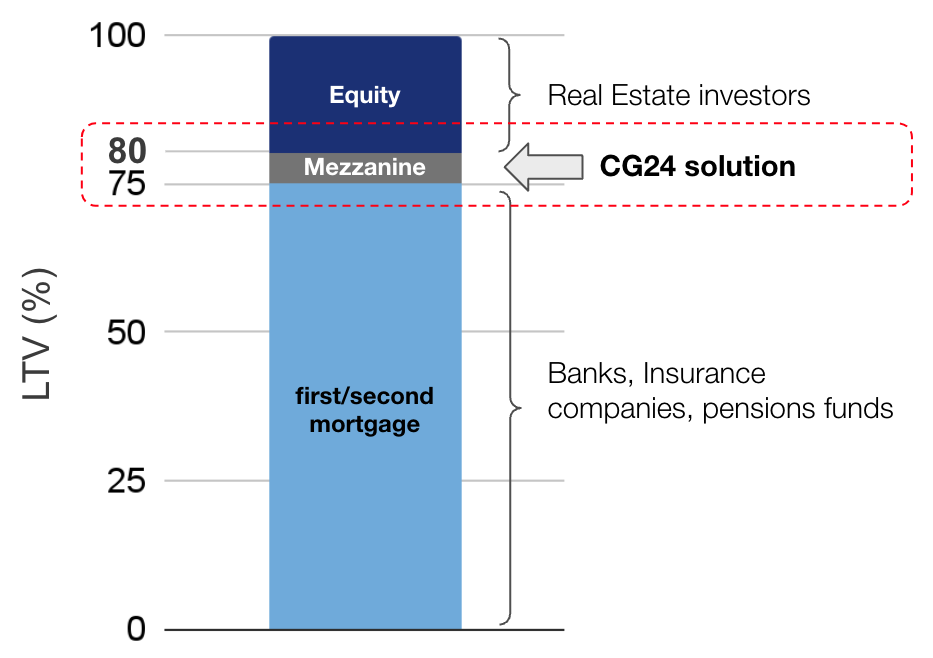

Banks and traditional lenders have been subject to increasing regulatory restrictions on the granting of mortgages for several years. In practice, this means that investment properties are mortgaged up to a maximum of 75%, taking into account the lowest value principle. Commercial properties are usually only mortgaged up to a maximum of 70%.

CG24 enables you to increase the loan-to-value ratio of a property, giving you more liquid funds in a short period of time. This gives you more scope for action and you can optimise or expand your portfolio by means of maintenance measures, renovations or acquisitions.

Your path to mezzanine capital

1

2

3

4

5

Application

You can submit an application directly via our platform, make an appointment with us, simply send us an email or contact us by telephone.

Once you have submitted all the necessary documents relating to the property, the owner and the borrower, we can start the free and non-binding assessment. Individual documents can also be submitted later (e.g. official documents due to processing time and any costs incurred).

Examination & indication

On the basis of the documents provided, we check the borrower’s creditworthiness as well as the credit standing and internally evaluate the property to be mortgaged. Within 48 hours you will receive a non-binding indication. This shows the financing options and conditions transparently.

Approval process & contract execution

Once the indication has been confirmed, the credit check is finalised and the financing is approved internally. The approval process takes a few working days, usually two to three. For a loan of over two million, the process may take a few days longer. If your loan application is approved, we will then immediately send you the contracts to sign.

Financing & establishment of collateral(s)

Your loan is published on the CG24 platform and financed by our investors. During the financing process, the corresponding mortgage is created and entered in the land register. We are happy to support you in this process.

Disbursement / ongoing process

Once the mortgage lien has been set up and your loan has been fully funded, the amount is paid out to you directly. The one-off closing fee will be deducted directly upon disbursement.

Interest and the maintenance fee are invoiced periodically on a quarterly basis. The interest invoices and an overview of the loan, including the repayment schedule, can be accessed at any time on our platform. Before the end of the term, you will be automatically informed by us regarding repayment and assisted with the return of collateral. If you wish to extend the loan, we will be happy to check this and show you the corresponding options.

Requirements for the object to be secured

Investment property located in Switzerland or Liechtenstein

Existing property

Rented with periodic rental income

Vacancy rate <10%

Commercial share of max. 30% for residential properties

Real estate investor with at least 3 years of market experience or comparable qualification

Your property does not meet the requirements?

We will be happy to examine a customised solution with you or show you which alternatives are suitable for you. Please get in touch with us.

The CG24 Real Estate Team

Relationship Manager Real Estate

Yaël Uehlinger

Relationship Manager Real Estate